Table of Contents

Public finance needs workers, and it can pay them well. A new study commissioned by the National Association of State Treasurers (NAST) reveals the challenges and opportunities that lie ahead as it competes with the private sector to recruit and retain workers.

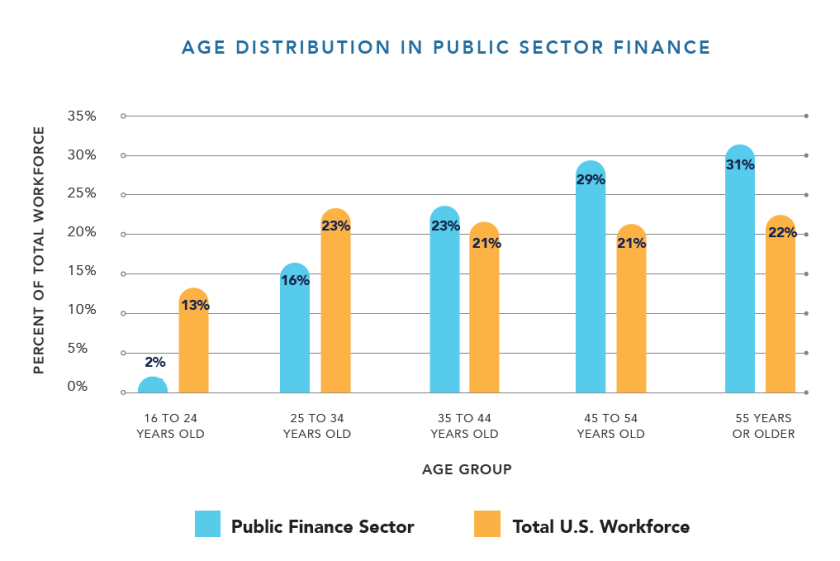

“We are entering a potentially tumultuous era of employment and staffing in the public finance sector,” said NAST in issuing the report. A significant factor in this concern is the study’s finding that 60 percent of public finance workers are over 45, and nearly a third are 55 are older.

At the same time, fewer than two in 10 public finance workers are 34 years old or younger, less than half the representation of this demographic in the total U.S. workforce. This is forcing a reconsideration of the best strategies moving forward.

Concerns about replacements for skilled and experienced workers who age out of their jobs aren’t new, says Mike Mucha, deputy executive director of the Government Finance Officers Association (GFOA). “This has come up over and over for the last decade or so,” he says.

“Before, we had focused on replacing the person at the top, but now it’s more about replacing individuals necessary to continue upward mobility throughout the organization,” says Mucha. “Bench depth is what’s lacking; it’s not necessarily that local governments are struggling to replace the CFO.”

Indiana State Treasurer Kelly Mitchell, the president of NAST, understands the need to keep the pipeline filled. She does not expect to lose experienced staff to the private sector, but finding new people who can move through the ranks and eventually assume leadership roles is a challenge.

Bench depth may be lacking, but demand is not. The need for workers grew at all levels of government between 2016 and 2020, across all states. The average annual growth rate for program analyst and budget specialist jobs during this period was more than 30 percent. A state-by-state accounting of job postings in 2019-2020 alone, included in the report, comprises nearly 90,000 positions.

Research commissioned by the National Association of State Treasurers found nearly 90,000 postings for public finance jobs in 2019-2020. (Scroll over states for details.)

Good Wages, An Open Door

The NAST report includes one finding about public finance jobs that went against expectations. “Going in, everybody assumed that your ability to make good money is far greater in the private sector than it is in the public sector,” says Joel Simon, vice president, workforce strategies for Emsi Burning Glass, which conducted the study.

In fact, salaries for entry-level and mid-career public finance jobs are somewhat higher than those for equivalent positions in the private sector. “It did surprise us,” says Mitchell. “That’s something we want to talk about, and the fact that these jobs are by no means just in big cities — they’re absolutely everywhere across the country.”

The share of public finance job offerings that don’t require a college degree is more than double that in private-sector finance. In addition, almost half the job postings in 2019-2020 required less than two years’ experience, while this was sufficient for only about a third of private finance sector jobs.

Lower entry requirements mean a “bigger door” for job seekers hoping to work in finance, says Simon. This, combined with better pay for workers in the early stages of their careers, can help public-sector recruiters compete with the private sector.

Hiring workers without post-secondary degrees might bring more young people into public finance, but it will only go so far in building a supply of replacements for older workers. In a series of charts in the NAST report illustrating pathways to upward mobility in various finance roles, there are no paths beyond entry-level jobs for those with only high school degrees. If these employees want to advance, they will need more education.

Finance As Public Service

Private finance job demand is about five times greater than the public sector. Because of this, undergraduate and MBA programs focus much more on preparing students for private-sector work, says Simon. Aside from encountering more offerings from private employers, graduates may not be primed to look for public-sector finance jobs.

“The idea of finance is very different in the public sector than the private sector,” says Mike Mucha of the GFOA. Public finance is public service, deploying budget resources to solve community problems, maintaining transparency, building public trust regarding stewardship of tax dollars. This can involve analytic and policy skills that aren’t necessarily covered in academic programs.

“What we’ve heard from a lot of our members is that there isn’t a direct pipeline from a university setting,” Mucha says.

Kelly Mitchell uses internships to show college students what it’s like to work in public finance, and to open their eyes to diversity of the job. “I sit on something like 15 boards,” she says. “They range from our finance authority to our housing and community develop authority, our bond bank, 911, college choice and on and on.”

Emphasizing the service aspects of this work, an important strategy in recruitment for government jobs, could help address a branding issue for public finance. “The idea of a sort of a high-flying, fancy-suited high finance person has some popular culture appeal,” says Simon. “I don’t remember the last time I saw a movie that featured a state treasurer, a city comptroller or a county office finance officer.”

(Dreamstime/TNS)

Recruitment and Retention

Retirement isn’t the only thing that could cause finance departments to lose experienced workers. As the NAST study confirmed, once workers pass mid-career, they can find private-sector work with better pay. However, it also found that since 2019, an average of only 1.11 percent left for private-sector jobs. It remains to be seen whether the record rate at which Americans are currently leaving their jobs, in search of change or better opportunities, will affect this trend.

The bigger challenge may be ensuring that workers at lower levels have a clear path to upward mobility and are prepared to take over when managers retire.

“One of the things that I really focused on this year as president of NAST was deepening connectivity across our offices — not just treasurers getting together, but chiefs of staff, directors of communication, all the levels in the office,” says Mitchell. “Have them connect with each other and then find out what can we provide in the way of education and training that enhances their skills or maybe grows their job duties and so in that way, working on retention.”

In some parts of the country, government finance offices are looking to the private sector for prospects. It can be an effective recruiting strategy to target auditors or private-sector accountants and provide the education necessary for them to transition to government accounting, says Mucha.

“You look at people that work in the nonprofit sector or some other kind of service-based industry and you bring them into budget positions or finance positions, because you’re hiring for like skill sets, not necessarily an exact level of experience.”

The pandemic forced a revelation that it’s possible to sustain productivity through remote work. This has the potential to change recruitment, says Mucha. “If I could work from home as the finance officer of my town, do I necessarily need to even be in the same town or state?”

Beyond this, telework opens up the possibility that three or four small towns could share a finance officer, or fill a technical or skilled position that they individually could not afford. “There’s a lot of potential there to fix some of the issues that local governments are facing,” he says.

It’s a harder sell than it was 30 years ago to ask workers to come to state or local government, says Rivka Liss-Levinson, senior research manager at the MissionSquare Research Institute. “But I think that employers can build on the fact that you have a very passionate, social justice-oriented young generation that is interested in making a difference.”

The Center of the Universe

The battle against COVID-19 caused many Americans to awaken to the importance of public health workers. It took an emergency to bring awareness to a vital government function and the workers who fulfill it, and Liss-Levinson hopes that efforts such as the NAST report can change this.

“I think there’s an opportunity to pay more attention to areas where there could be shortages in workers or difficulty in recruitment, and how you can help attract and retain employees now rather than waiting until it’s an emergency situation where you’re not going to be able to provide services because you don’t have enough workers.”

Without the public finance workforce, things just don’t happen — or they don’t happen correctly, says Kelly Mitchell. Whether the general public knows it or not, it’s critical that the sector has trained, committed and consistent people that know their jobs and do them well.

“The budget is, basically, the center of the government universe,” says Mucha. “It’s where decisions about what’s important get funded.”

https://www.governing.com/work/despite-solid-pay-public-finance-has-workforce-challenges

More Stories

Options Trading And Volatility

Seo Strategies For Financial Institutions And Services

Role Of Market Makers