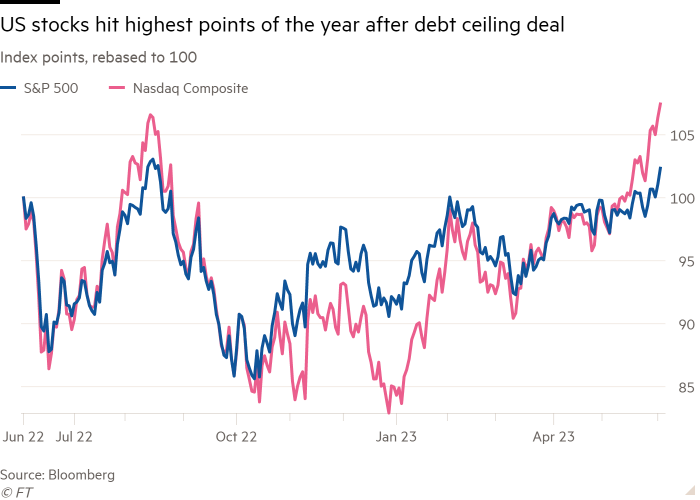

US stocks advanced on Friday, with the S&P 500 index recording its largest just one-working day increase because April, immediately after traders cheered the newest jobs report and the passage of the personal debt ceiling bill in the Senate.

The Wall Avenue benchmark S&P 500 rose 1.5 per cent to its optimum level since August, marking its 3rd straight week of gains with a 1.8 for each cent improve.

The tech-significant Nasdaq Composite additional 1.1 per cent to a stage final reached in April 2022. Its weekly boost of 2 for each cent introduced the index its sixth consecutive 7 days of gains.

The Cboe’s Vix index, a evaluate of stock marketplace volatility which is generally referred to as Wall Street’s “fear gauge”, fell to 14.60, its cheapest close given that February 2020.

Investors began the working day on the front-foot immediately after the US Senate on Thursday approved a offer concerning the White Residence and congressional Republicans to lift the financial debt ceiling for two a long time in trade for cuts to govt paying.

The accord ended a months-long political stand-off that risked triggering an unprecedented personal debt default in the world’s greatest financial system.

Stocks were being even further buoyed by facts from the US labour office exhibiting non-farm payrolls rose by 339,000 in May perhaps, properly over the 190,000 consensus estimate of economists polled by Reuters, an unexpected indication of labour current market toughness. The unemployment charge rose to 3.7 for every cent from 3.4 per cent in April and wage expansion edged down on an yearly basis to 4.3 per cent.

“While work advancement was shockingly solid, other information from the establishment painted a additional complicated picture of the labour market,” Financial institution of The usa analysts wrote. “While average hourly earnings are not the greatest measure of wage growth the trend does propose some slowing of wage inflation pressures relative to a 12 months ago.”

However, the headline figure signalled resilience in the US overall economy, creating it a lot more probable that the Federal Reserve will continue to enhance fascination charges in an hard work to deliver down inflation.

Marketplaces put a 29 per cent probability of an interest price boost in June, according to Refinitiv, marginally up from about 25 per cent on Thursday. The likelihood of a quarter-point boost by July was priced in.

“The numbers nowadays are possible only going to add gas to the fireplace that the Federal Reserve has to raise rates at the time again, despite before this calendar year showing to be all set to press pause on the hikes,” said Marcus Brookes, main investment officer at Quilter Traders.

The yield on the US two-year Treasury, which is far more delicate to monetary plan anticipations, was up .16 share details at 4.50 for each cent immediately after the release of the work opportunities report. The yield on the 10-12 months was up .07 proportion factors at 3.70 for every cent. Bond yields increase as prices drop.

The dollar, which moves when investors anticipate greater fees, extra .5 for each cent towards a basket of six peer currencies.

The pan-European Stoxx 600 closed 1.5 per cent higher, even though London’s FTSE 100 extra 1.6 for each cent. France’s Cac 40 obtained 1.9 for every cent.

The shares of London-mentioned Dechra rose 7.6 for each cent just after the veterinary prescribed drugs business agreed a £4.5bn buyout by Sweden’s EQT, in what would be a single of the most important United kingdom private equity deals of the calendar year.

Marketplaces in Asia rallied. Hong Kong’s Hang Seng index led the location with a increase of 4 per cent, as web and tech shares led a rebound.

China’s CSI 300 index of Shanghai- and Shenzhen-shown shares rose 1.4 for each cent. South Korea’s Kospi obtained 1.3 per cent and Japan’s Topix was up 1.6 for every cent.

Oil selling prices rose, with West Texas Intermediate, the US marker, incorporating 2.1 per cent to trade at $71.56 for each barrel, even though intercontinental benchmark Brent crude rose 2.3 per cent to $75.98.

More Stories

Impact Of News And Sentiment On Markets

Livestock Health And Disease Management

Remote Sensing In Precision Agriculture